My trusty-old iPhone 6 plus has served me well over the years. Admittedly, it’s a bit behind the times, but I think I have gone past the stage where I felt like I had to own the most advanced, cutting edge phone, thats’s out there. For a 5 year old phone, it was in a good enough condition with no more than a couple of minor dents to the body.

My phone in happier times

All that changed about 10 days when I accidentally dropped my phone, face-down. As it lay there, lifeless, I remember looking down at it & praying for a miracle. It wasn’t to be. I had tempted fate too many times and after all these years, my luck had finally run-out. The impact left the screen shattered, with fragments of broken glass barely held together.

My American Express Card to the rescue

I have had The American Express Explorer Card for few years now. The card comes with a tonne of benefits, one of which is the Smartphone screen protection cover. The cover is provided by Swiss insurance giant, Chubb.

The cover isn’t automatic though. To be eligible, you should have paid for the phone with your card, either outright or through a monthly plan. When you do so, you are covered for any accidental damage to the screen of up to $500 per year. A 10% excess is payable and you can make up to 2 claims each year.

In my case, I was covered by the virtue of paying my monthly plan fee through the card.

The Claim Process

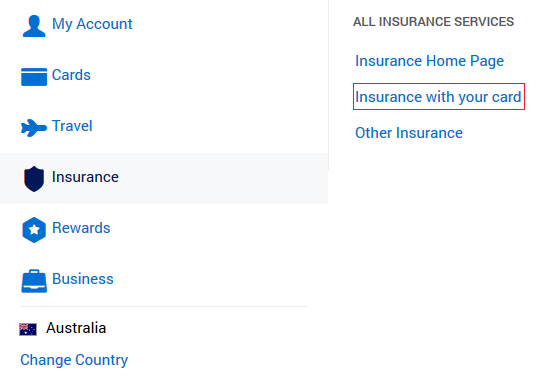

American Express allows you to get the screen fixed by a repairer of your own choice, prior to submitting a claim. Once you have done this, log into your account and look for the Insurance section, navigate to ‘Insurance with your card‘ and click on it.

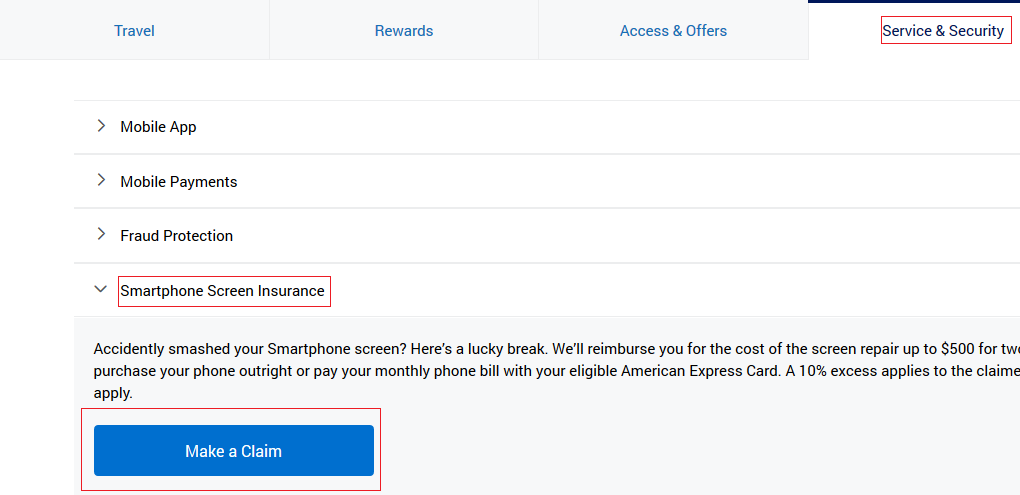

This will take you to a page displaying all cards issued by American Express. Select your card, which in this case is The American Express Explorer Credit Card and navigate to the page shown below:

From here on, click on ‘Make a Claim‘ and follow the instructions.

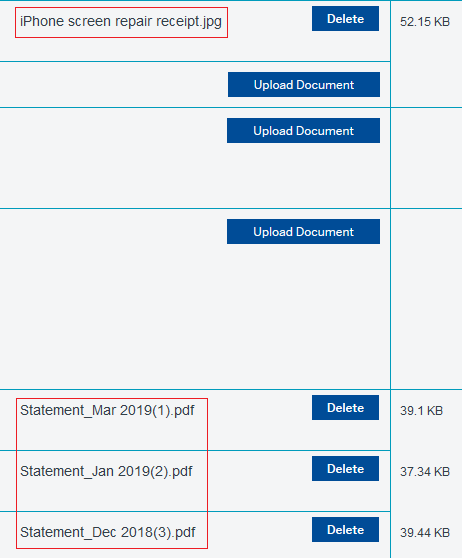

As long as you have the required documents, ie, a copy of the receipt of the repairs and a copy of your American Express Explorer Credit Card statement showing the outright purchase of your mobile phone or payment of your monthly phone bill, the process should take under 10 minutes.

In my case, I submitted a copy of the receipt of the repairs and previous 3 months statement as proof.

The next day I received an email from Chubb asking me to provide a copy of the monthly contract with my phone provider, which I did.

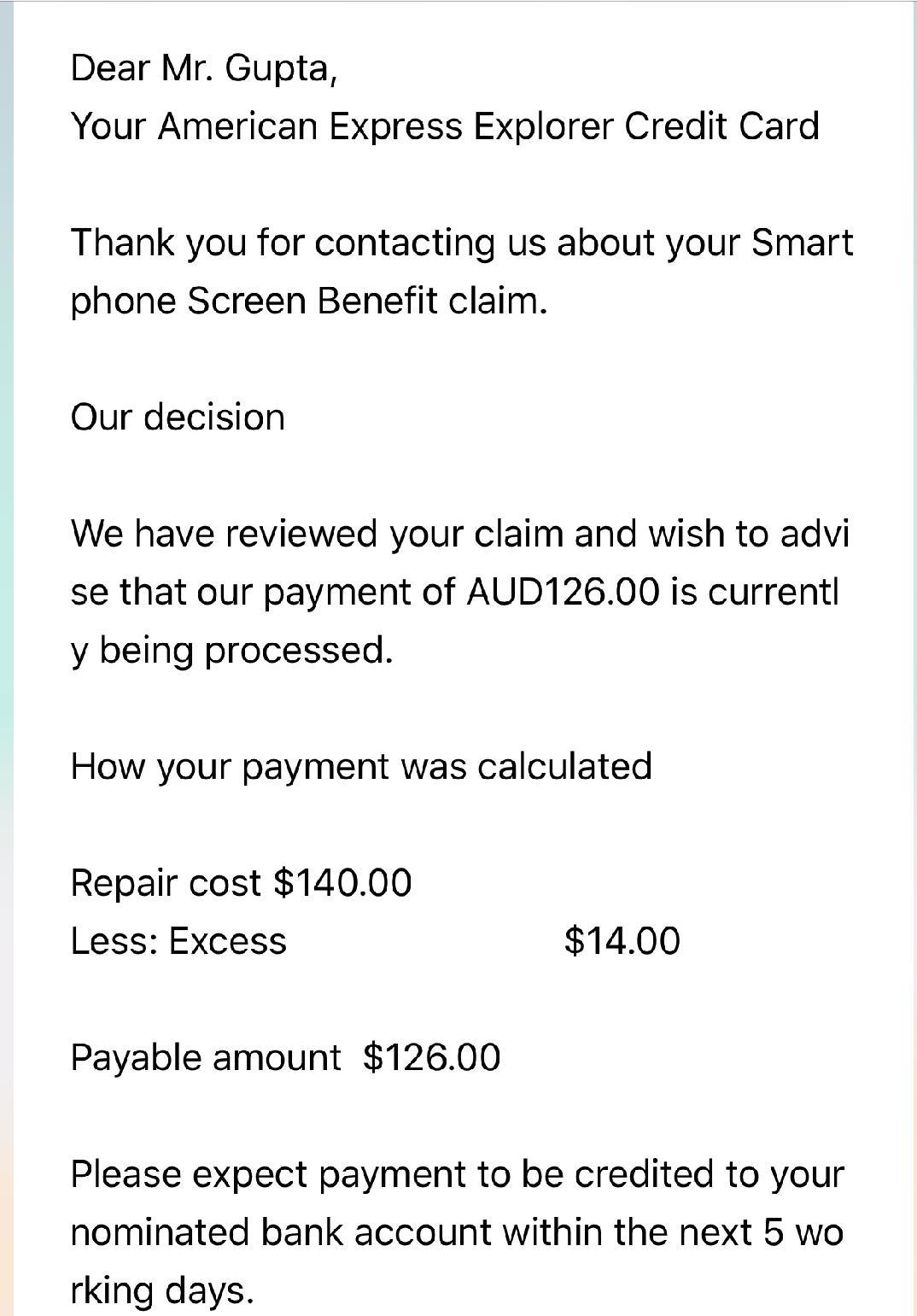

A couple of days later, I received an email confirming that the claim has been approved.

I paid $140 for the repairs. After deducting the 10% excess ($14), American Express reimbursed me the remaining $126. There was nothing more, or less to it.

In Conclusion

We have all heard stories of insurer’s trying every trick in the book to wiggle out of paying the claim. I am happy to report that my experience was nothing like it.

This was the 1st claim of any kind that I had ever made & wasn’t really sure how it will go. As it turned out, the claim was approved in just over a week, with funds credited in my bank account soon after. It was a simple, efficient, reasonably quick process.

While the primary focus of getting a credit card is to maximise points and miles earn, sometimes we do not fully appreciate the additional benefits that come with it. Cards that come with included insurance provide peace of mind, how do you put a price on that?

If you would like to learn more about The American Express Explorer Credit card, check out my in-depth review over here.

Do you have a credit card with included insurance? Have you ever made a claim? Leave a comment below.

Great! It is not very often that we gear happy stories about a claim!

*hear

When it says Outright or monthly plan I thought that was just through say Apple… I didn’t know it includes buying iphone through Telstra/Optus etc. and paying that off monthly with the card!! If only i knew… unluckily i only smashed phone once in the years I’ve had the amex.

Hi Denis, it covers both mode of payments. Never mind, you will be ready should you ever need to take advantage of this feature again 😉