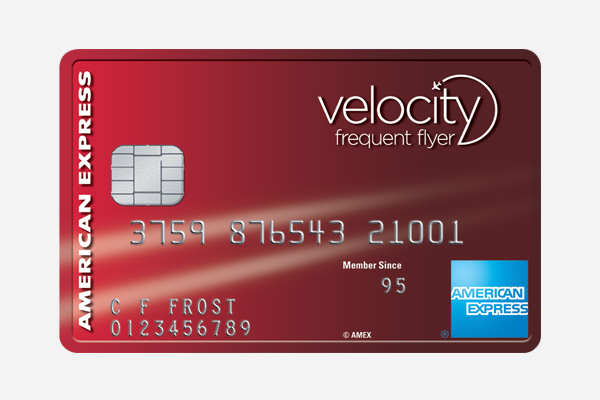

The American Express Velocity Escape Card is the base level American Express-Velocity co-branded card in the Australian Market. This card will appeal to those who want to kick off their Velocity points earning journey, but don’t wish to pay hundreds of dollars per year in fees on more premium cards.

Prominent Features & Fees

- Annual Fee – $0, Foreign currency transaction fee – 3%

- Welcome Bonus – Nil

- Rewards Program – Velocity Frequent Flyer

- Airline Partner : 1

- Insurance – Purchase & Refund Protection

Annual Fee

The Velocity Escape card is a no annual fee card, which is pretty good for a rewards card. Most of the other rewards card in the Australian market charge some degree of annual fee which makes this card stand out.

You can also order up to 4 additional cards for family members or friends at no extra cost.

For transactions made overseas or with overseas based businesses, a 3% foreign currency transaction fee is applied to the converted Australian dollar amount. So you may want to avoid using the card outside Australia.

Welcome Bonus

The card has occasionally offered a Welcome Bonus of up to 10,000 Velocity points. However, as of the time of writing of this post, there is no Welcome offer on the card.

Rewards Program

The American Express Velocity Escape card earns Velocity points. The card earns uncapped 0.75 Velocity point per $ on all spends, except on payments to Government bodies, where it earns 0.5 Velocity point per $. This isn’t a lot, but is better than several Visa & Mastercard issued cards which don’t earn any points on Government spend.

However, the card really shines on purchases made with Virgin Australia, such as on flights and holiday packages where the earnings rocket to a very impressive 1.75 Velocity points per $.

Earn 1.75 Velocity points per $ spent with Virgin Australia

At the end of each month, once your monthly statement is generated, these points are directly transferred to your linked Velocity account.

Airline Partner

There are several American Express cards in Australia which earn Membership Rewards points. These points can subsequently be transferred to a number of different airline partners. The Velocity Escape card though, earns Velocity points exclusively, and as such, is targeted at those prioritizing Velocity points.

You can also transfer Velocity points to Singapore Airlines KrisFlyer Program, thanks to the close partnership between the two airline. This can open up redemption possibilities on dozens of Star-Alliance partner airlines too.

Transfer Velocity points to Krisflyer and redeem for Lufthansa Business Class

You can read more details about this partnership and how to initiate the transfer over here.

Insurance

The American Express Velocity Escape card is insurance-light. There is no complimentary Travel Cover, Rental Car Damage Waiver or Smartphone Screen Protection etc. If those are important to you, you may want to consider getting The American Express Explorer Credit Card. That said, the card does offer a couple of handy protections.

Purchase Protection

Under Purchase protection, you are covered for up to $10,000 per year and up to $2,500 per claim ($50 excess applies) on items stolen or damaged within 90 days of purchase. To activate this cover, you must have paid for your purchase with The Velocity Escape card.

Refund Protection

This is another useful cover to have for situations where you have simply had a change of mind after the purchase, and for whatever reason, the retailer will not take it back. Under these circumstances, items paid for by the Velocity Escape card can be returned to American Express, who will reimburse you with an amount specified under the terms of the cover.

There are conditions attached to each of these cover and it’s important that you familiarise yourself with them by referring to The American Express Velocity Escape Card Insurance Terms & Conditions.

Who can apply?

This brings us to the last but an important question, who can apply for this card?

You are eligible to apply for this card if you meet the following conditions:

- You are at-least 18 years old.

- You are an Australian citizen, permanent resident or on long term visa. (1 year or over).

- You have pre-tax income of $40,000 pa or more.

- You have a good credit history and no payment defaults.

In Conclusion

The American Express Velocity Escape Card offers a No Annual Fee option to members of Velocity Frequent Flyer Program. The regular earning rate is fairly respectable and like all American Express Cards, The Velocity Escape Card also comes compatible with both Apple Pay and Samsung Pay.

If your intention is to rack-up hundreds of thousands of points in a short period of time, this card won’t do that. However, if you are someone who wish to slowly establish their feet in the points and miles universe, but don’t want to shell-out for the privilege of doing so, this card should be in your consideration.