Amex are sending cardmembers emails about several targeted bonus points offer. If you have an American Express card, I highly recommend you check your email to see whether you have been targeted. Personally, I have a number of American Express cards and I have been targeted with bonus points offer on some of them, as I explain below.

Before I get into the nitty gritty though, here are some important details about these offers:

- The offers do NOT appear under Amex Offer, the only way you are able to earn bonus points is if you have received an email from Amex inviting you to enrol.

- If you have received the email, click or tap on the SAVE OFFER TO CARD logo (see later in the post) and you are good to go.

- Only spends on the card targeted are eligible to earn bonus points, spendings made on other cards such as additional cards do not count.

- As per the email, bonus points will be awarded 1-2 weeks after the end of promotional period.

Up to 12,500 Bonus Points on Amex Explorer

The American Express Explorer Credit Card is one of my oldest cards. The card earns 2 Membership Rewards points per dollar on all but Govt related transactions where the earnings drop to 1 point per dollar.

Until Amex devalued the program back in April 2019, this was my go-to card for most day to day spends. The bonus points offer I have received on this card is 2 tiered :

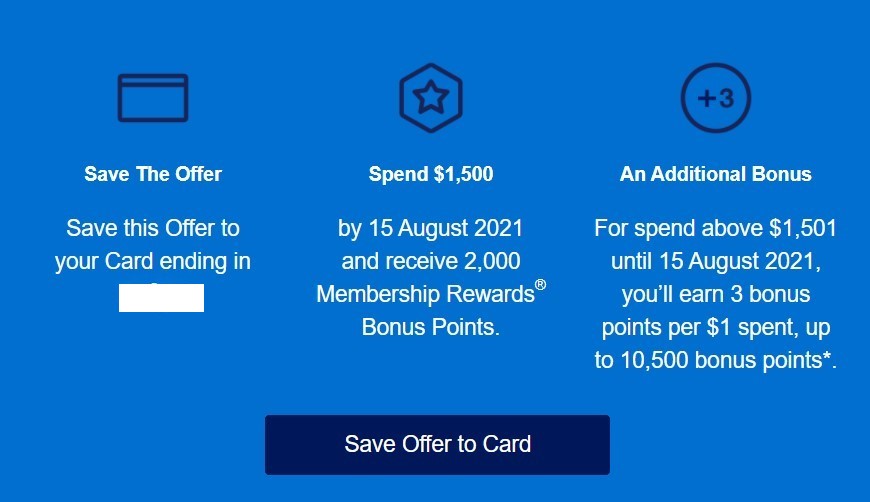

Tier 1 – Spend $1,500 by 15th August and earn 2,000 Bonus Points

Tier 1 works exactly as it says, Spend a total of $1,500 by 15th August 2021 to earn 2,000 bonus points. In isolation, this is a pretty ordinary offer awarding a paltry bonus of 1.33 points per $.

However, meeting the spend automatically unlocks the next stage of the bonus, which is a lot more valuable.

Tier 2 – Extra 3 points per $

Upon meeting the initial spend requirement, until 15th August 2021, I will be earning an extra 3 bonus points per $ for spends above $1,501 up to a total of 10,500 bonus points. Note that these points are over and above the standard earning rate of this card, as discussed earlier.

In short, to maximise this offer and earn the full allocation of 12,500 bonus points, I will be required to spend a total of $5,000 by 15th August 2021. At that level, the bonus points earning translates into an extra 2.5 points per dollar, which is pretty amazing.

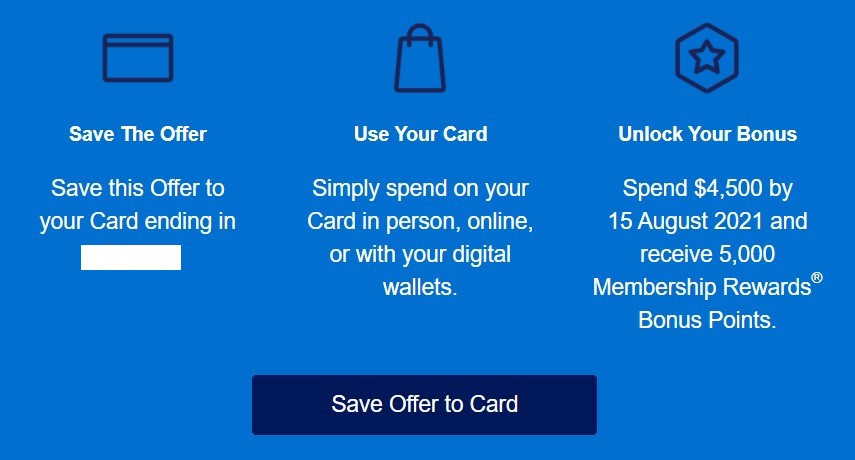

5,000 Bonus Points on Amex Platinum Edge

The American Express Platinum Edge Credit Card is one of the best cards for supermarkets & petrol station spends in Australia. At these places, the card earns 3 Membership Rewards Points per $ which is a very good return. The earnings outside these places drop to just 1 point per $, so I mostly only use this card to buy grocery and put fuel in my car.

The bonus points offer on this card is pretty poor. I will earn 5,000 bonus points if I can spend a total of $4,500 by 15th August 2021. Note that there are no incremental points for any spending, so if you have been targeted for this offer, it only really makes sense to direct your spend to this card if you are confident of hitting the $4,500 mark by the due date.

Even at that level, the bonus points earning translates into a very ordinary 1.11 extra points per $. Barring any significant changes in my circumstances, I don’t see myself taking advantage of this offer.

Up to 18,000 Bonus Points on Amex Platinum

The American Express Platinum Card is top of the range card in Amex’s portfolio. It’s main attraction lies in the multitude of travel & lifestyle benefits it offers cardmembers, but since we are talking about bonus points, let’s stick to that part for now. The card earns 2.25 Membership Rewards points on all transactions except where you make payments towards a Govt or Govt related expenses where the earning drops to just 1 point per $.

Truth is stranger than fiction, as the saying goes. Common sense dictates that your premium, most expensive card receive the most attractive of offers. But in a rather confusing turn of events, the offer on my Platinum card is, a dud, to put it mildly.

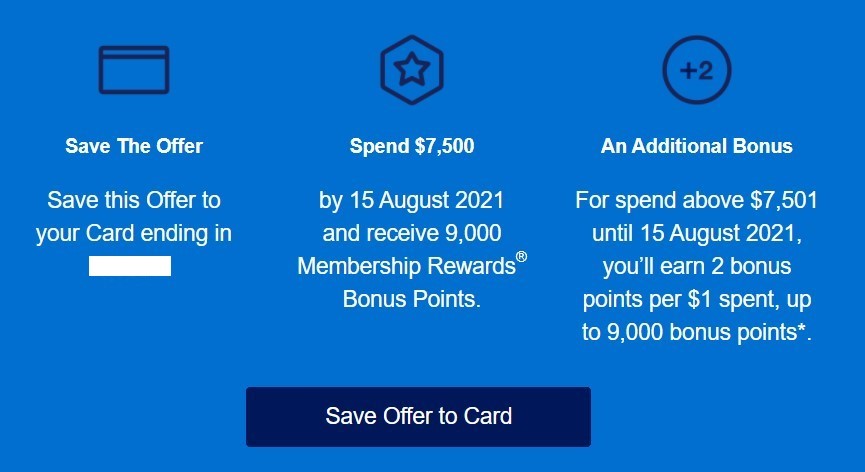

Like the Explorer, the bonus points will be awarded in 2 stages :

Tier 1 – Spend $7,500 by 15th August and earn 9,000 Bonus Points

Just as it says, I will be required to spend a pretty steep $7,500 on this card to earn 9,000 bonus points. That’s an extra 1.2 points for such a massive spend. Meeting this requirement unlocks the next stage of the offer, which, is only a small improvement on stage 1.

Tier 2 – Extra 2 points per $

Upon meeting the initial spend requirement, until 15th August 2021, I will be earning an extra 2 bonus points per $ for spends above $7,501 up to a total of 9,000 bonus points. Like the offer on Explorer, these points are over and above the standard earning rate of the card.

In short, to maximise this offer and earn the full allocation of 18,000 bonus points, I will be required to spend a massive of $12,000 by 15th August 2021. Even after attaining the spend, the bonus points earning translates into a bonus of just 1.5 points per dollar, which is pretty meh 😒

In Conclusion

Amex are sending cardmembers a whole range of spend based bonus points earning opportunities. On proprietary American Express cards, these are to earn bonus Membership Rewards points, but on cobranded Qantas & Velocity points earning cards, these could be in the form of bonus points in those respective currencies.

Not all offers are equal, as seen above. If you have been targeted with one or more of these offer, make sure the spending requirements align with your own valuation of those bonus points before you start spending money on that card.

Have you been targeted with any offers? Leave a comment below.