The thing I love most about American Express Cards is that they pretty much pay for themselves. What I mean by that is that you can easily recoup the cost of annual fee (plus some) via the included benefits & perks such as the Travel Credit, Lounge Access & Amex offers to name a few. This is true for propriety American Express cards (ie, cards that earn Membership Rewards Points) and the co-branded cards (Qantas and Velocity points earning card) both.

However, this does not mean you shouldn’t try and extract even more value out of them. And one of the best time to do that is when your annual fee becomes due. This is the time to decide whether to pay the fee and keep the card for another year or cancel it.

While shelling out hundreds in fees is nobody’s idea of having fun, it need not necessarily be doom and gloom. Matter of fact I look forward to the anniversary month on my cards as they often bring me a bounty of free points.

In this post, I want to talk about how you should go about negotiating a retention offer on American Express Cards. Let me say this at the outset, no strategy is full-proof and nobody can guarantee that you will be successful in getting an offer from Amex. That outcome is purely determined by a complex set of algorithms Amex employs.

However, if you follow this guide you may just give yourself the best chance to walk away with a positive outcome.

Retention Offer on Phone or via Online Chat

There are two ways you can communicate with Amex, you can either call them on phone or contact them online via the LIVE Chat Service. There is nothing to suggest that any one of these medium brings a greater chance of success over the other.

I personally prefer the Chat as it allows me to do whatever else I am doing on the computer and does not tie me up which can sometimes happen over the phone.

Whichever way you contact Amex, expect that you will be passed at least 2-3 times between representatives until you get in touch with someone in the retention team, folks who are actually authorised to make retention offers. So there is no point wasting time with the initial rep who engages you.

What not to Say

Before I talk about how you should start your discussions on a retention offer, it is worth pointing out some of the things you should NOT say to the rep.

- Do Not ask for a Retention Offer – This is one of the most common mistakes card members make when trying to negotiate an offer. In the past, it was possible to ask and often receive an offer, however this strategy stopped working quite some time ago.

These days, the agents will most likely give you one of the two responses, A), there is no retention offer on your account, or, B), we are not allowed by law to make retention offers.

- Do Not ask for Annual Fee Waiver – If you ask Amex to waive the annual fee, there is 99% chance it will be refused. Amex just do not waive the annual fee, plain and simple. So it makes little sense to veer the conversation in that direction.

My Personal Experience Negotiating a Retention Offer

The annual fee on my American Express Platinum Edge Card comes up for renewal each year in April. The card has a $195 annual fee which is more than offset by the $200 travel credit you receive each year. So effectively, the card is free.

At 3 points per $1, The Platinum Edge Card is one of the highest points earning card in Australia for Supermarket and Petrol Station spend. So this is a card that has a permanent place in my wallet, unless a new more rewarding card comes in the market.

If you have ever considered getting this card, now is an excellent time to apply as Amex are currently offering a fee waiver in the first year, saving you $195. For more on The Platinum Edge Credit Card, check out my full review over here.

Now back to the negotiation.

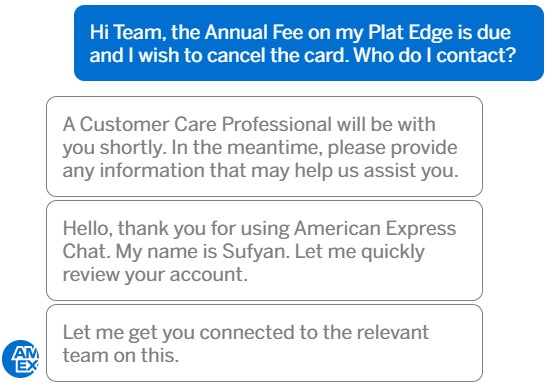

I got things rolling by logging into my Amex account and opening a new Chat window. Right at the outset, I told the rep I wanted to cancel the card as I did not wish to pay the $195 annual fee. Hearing that, the rep immediately palmed me off to the next rep as you can see from the excerpts of my chat below.

I then spent the next 10 minutes doing a security check with the 2nd rep until my identity was fully established. He then passed me on to another agent to carry forward the cancellation process. This was the rep from the retention team. His name was Mason.

Mason started the conversation by verifying that I was indeed looking to cancel the card, which I confirmed I was. He then sent me a big disclosure about the cancellation which I had to read and agree to.

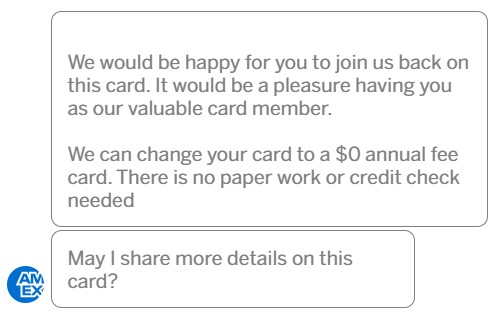

He then asked me why I wanted to cancel the card, I told him I did not want to pay the annual fee as the card was surplus to my need. Mason then tried to switch me to the $0 annual fee Essentials Card as you can see from the chat below.

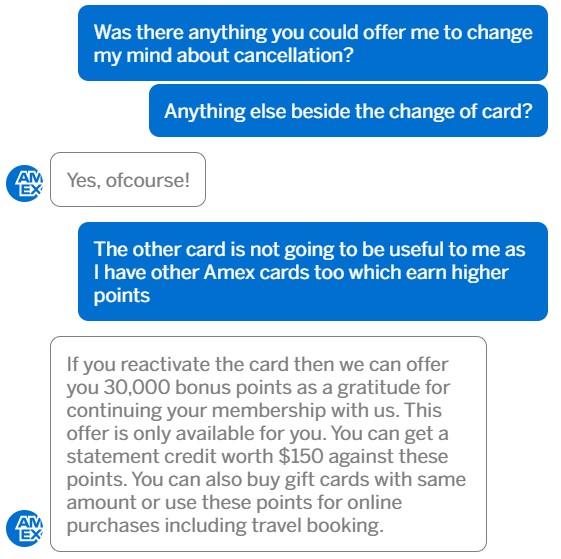

I replied by saying that I was not interested in the $0 annual fee card as I had other Amex cards that were far more rewarding. I then asked Mason if there was anything else he could offer to change my mind, see the exchange below.

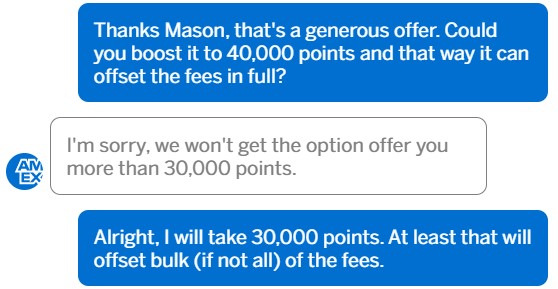

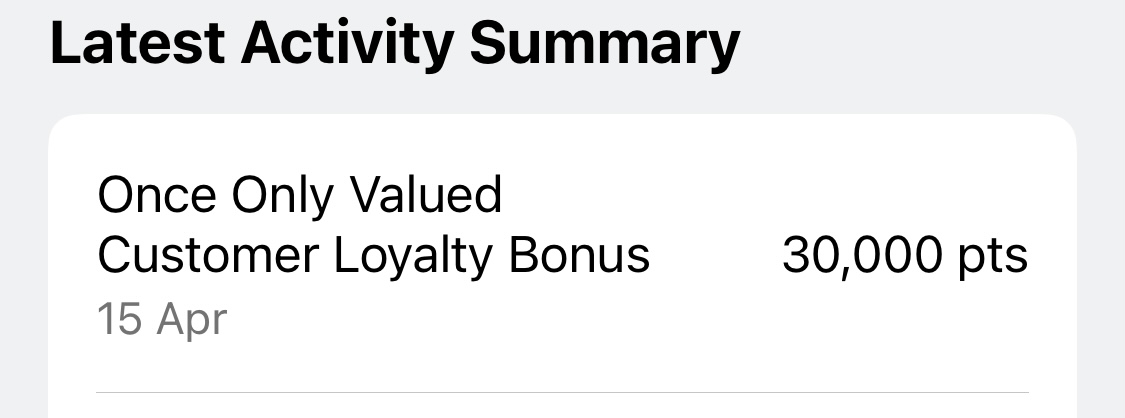

At this point, Mason came forward with a retention offer of 30,000 Membership Rewards Points (see above) in exchange for keeping the card for another year. I was pretty happy with the offer but I wanted to see if I could push Amex a little harder, so I asked Mason if he could bump-up the offer to 40,000 points.

The retention offers are hard-coded to individual accounts and the agents cannot modify them, as you can see from Mason’s response above. So I ended up accepting the offer.

Those 30,000 Membership Rewards Points are enough for a one-way Business Class flight flying Air New Zealand between Australia and New Zealand. In terms of cash value, the flight generally sells for hundreds of dollars. Not bad for spending 15 minutes on the chat 😉

Although I was told it make take 3-5 days, the bonus posted in less than a day.

Negotiating Tips

As I said earlier, there is no guaranteed template for success – but here are some handy tips that may improve your odds.

- Be nice to the rep at all times, even when you know they are lying. The purpose of making the call is to come away with something in return, not to prove you know better.

- Do not take NO for an answer until you have made a few attempts. If you don’t get your desired outcome, hang-up and call again or open a new chat. You will hopefully communicate with a different agent and get to plead your case again.

- This may seem silly but try and call during different times of the day. There is anecdotal evidence to suggest card members have a greater chance of success dealing with overseas staff than the one’s based in Australia.

- Don’t start the conversation threatening to cancel the card. The person you are talking to isn’t incentivised to retain customers. Successful negotiation is a slow-burn, take your time, spin a yarn if you have to.

- If you want to keep the card, but are requesting a cancellation solely to see if it triggers a retention bonus, make sure you get the card reinstated during the same call or chat session. Not doing so will lead to permanent cancellation and you will then need to re-apply for the card.

- Understand and accept that despite your best efforts, sometimes you may walk away empty handed.

In Conclusion

Negotiating a retention offer is not an exact science. What works for someone else may not necessarily work for you. That said, this was the third time in 2023 I had employed this strategy and am pleased to report that the strike rate has been 100%

I was offered 30,000 points on all 3 occasions but your offer could be lower or higher. I have heard offers as low as 10,000 points and as high as 150,000 points being made. If you are in a situation where your annual fee has posted or will post shortly, I suggest you contact Amex and see if you can squeeze some extra points out of them. There is no downside to it.

Have you ever negotiated a retention offer? Leave a comment below.

Hi, these are amazing tips! Do you know if it works with other credit card companies?

Hi Roxy,

I am not aware of retention offers on non Amex cards. But no harm in trying.