I am a huge fan of American Express Membership Rewards Program. I rate Membership Rewards points very high in the pecking order, ahead of Qantas or Velocity points and take every opportunity to earn them. The best part about these points is that they are extremely easy to earn, can be transferred to up to 12 different Travel Partners and unlike individual loyalty program points, do not expire.

With Virgin Australia in voluntary administration and Velocity suspending redemption’s (albeit temporarily), the perils of putting all your eggs in one basket (ie earning only 1 type of points) have never been more clearer. So if Velocity or Qantas points are the only points you have been earning till date, now is a good time to start looking at your options.

Membership Rewards Points & Travel Partner

Membership Rewards points are the proprietary points currency of American Express Membership Rewards Program. The only way to earn them is by acquiring one of the American Express Cards and putting your everyday spends on them.

The number of points you earn depend on the type of card you have and range anywhere between 1 and 3 points per $. You can transfer these points to majority of its airline partners in the ratio of 2:1 (2 Membership Rewards points = 1 Airline point).

Depending on the type of card you have, there are up to 10 airline partners & 2 hotel partners to choose from. These are :

- Virgin Australia Velocity Frequent Flyer

- Singapore Airlines KrisFlyer

- Etihad Guest

- Emirates Skywards

- Malaysia Airlines Enrich

- Thai Airways Royal Orchid Plus

- Cathay Pacific Asia Miles

- Air New Zealand Airpoints

- Virgin Atlantic Flying Club

- Qantas Frequent Flyer

Then you have the 2 hotel programs in:

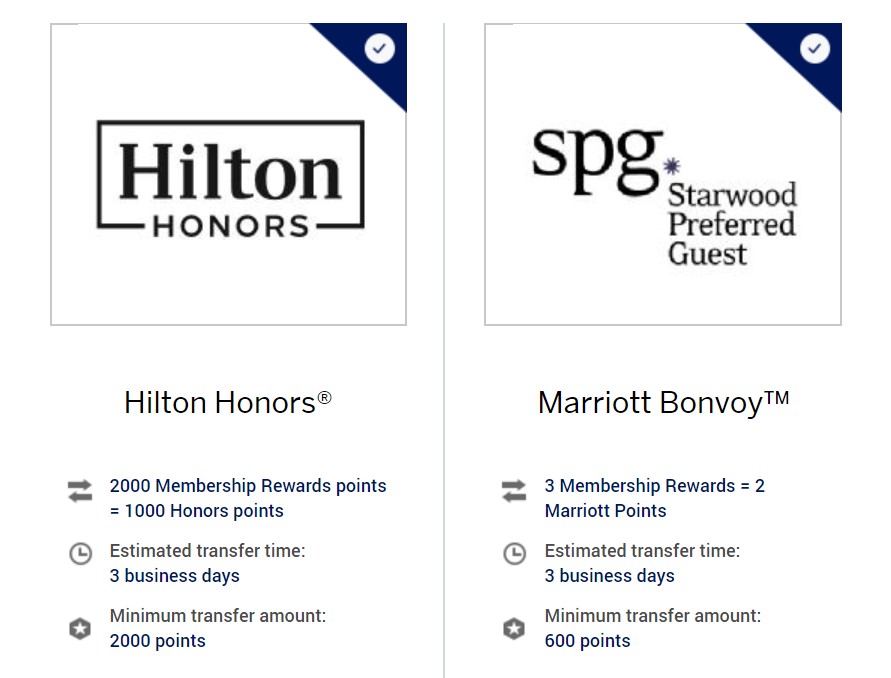

The transfer rate to Marriott Bonvoy is 3:2, while points to Hilton Honors transfer at 2:1 as can be seen below :

Transfer Membership Rewards Points to Marriott or Hilton for hotel stays

American Express Cards

There are several American Express cards in the Australian market, ranging from no annual fee card, to the top of the range, invite-only Centurion card which comes with truckloads of benefits and an eye-watering $5,000 annual fee. Not every card is suitable for everyone, the question about which card is right for you can only be answered by looking at your own personal circumstances.

In Australia, you can earn Membership Rewards points with the following personal cards:

- The American Express Essential Credit Card (read full review)

- The American Express Explorer Card (read full review)

- The American Express Platinum Edge Card (read full review)

- The American Express Platinum Card

Let’s take a look at each of these briefly.

The American Express Essentials Card

This is the base level, no-frills card to come out of the American Express stable. With this card :

- You pay no annual fee, that’s right, it’s a FREE card.

- You earn 1.25 Membership Rewards points per $ on all transactions except Govt or Govt related spends where the earnings drop to 1 point per $.

- Complimentary smartphone screen insurance, which is a really good benefit to have, particularly for a no annual fee card. To be eligible for this cover, you must have paid for the phone, or be making the monthly ongoing payments for your phone via your American Express Card.

Apply here for The American Express Essentials Card

The American Express Explorer Card

At present, I rate this card as the best value American Express card for most people. With this card:

- You pay $395 in annual fee. However this is fully offset by the $400 per year in Travel Credit that comes with the card. Just to emphasise, the $400 travel credit is not a once off feature, but is provided each year you retain the card. You can use this credit to book flights, hotels, car-hires or experiences through Amex Travel, as shown below.

Video credit : americanexpress.com.au

- You earn 2 Membership Rewards points per $ on everything, except Govt or Govt related spends where you earn 1 point per $.

- A range of complimentary insurances including Travel Insurance & Smartphone screen insurance.

Apply here for The American Express Explorer Credit Card

The American Expresses Platinum Edge Card

If you spend a lot of money on fuel and household groceries, it’s hard to go past The Platinum Edge card. With this card:

- You pay $195 in annual fee, which is fully offset by the annual $200 travel credit.

- You earn 3 Membership Rewards points per $ spent in supermarkets and at fuel stations. That’s like earning 1.5 airline points per $ in the program of your choice, which makes it one of the highest earning cards in Australia for these 2 categories. Most major super markets and fuel stations are included.

- You will earn 1 Membership Rewards point on all other spends, including Govt and Govt related transactions.

- A range of complimentary insurances including Travel & Purchase Protection Insurances.

Apply here for The American Express Platinum Edge Card

The American Express Platinum Card

If you have a taste for finer things in life, this card is taylor-made for you. It comes with choke-full of travel & lifestyle benefits designed to please the most discerning of travellers. All that however, comes with a hefty price-tag. With this card:

- You pay $1,450 in annual fee. There is annual travel credit of $450 included, plus you are also eligible to get a free Platinum Reserve Card which comes with its own $400 travel credit. So all up, you get $850 in travel credit annually which goes quite a way in offsetting the annul fees.

- You earn 2.25 Membership Rewards points per $ on everything, except Govt or Govt related spends where you earn 1 point per $. However, American Express is currently running a 3 month promotion where you can earn 2X the standard no. of points. This means, until 20th July, you will earn 4.5 Membership Rewards points per $ on everything except Govt & Govt related spends where you will earn 2 points per $.

- Complimentary Accor Plus membership (worth $395 pa) which comes with the Silver Status in the program and a free anniversary night at any participating Accor property in Asia-Pacific.

- Free Access for you and a guest to over 1,300 airport lounges. This includes Priority Pass lounges, Centurion & American Express lounges, Plaza Premium lounges, Virgin Australia lounges (when flying with them) and Delta SkyClub lounges.

- A range of complimentary insurances including Travel, Rental Car Damage Waiver and Smartphone screen insurance.

- Complimentary Australian Financial Review digital subscription (worth $628 pa).

- Ability to transfer points to Qantas Frequent Flyer program.

The list of benefits is extensive, what I have mentioned above are just a few of those.

Apply here for The American Express Platinum Card

Disclosure : If you apply for any cards using the link in this post and are approved, pointsHq or it’s related entity may receive some referral points.

Redeeming Membership Rewards Points

There are numerous ways to redeem your points. You can use points to offset purchases made on your card, redeem them on Amex Travel online, redeem them for gift cards or other merchandise. However, you maximise the value of your Membership Rewards Points when you transfer them to one of it’s airline partners and redeem them for business and first class flights.

Below, I have listed a few examples.

- Redeem 90,000 Asia Miles to fly Qatar Airways Qsuites from anywhere in Australia to New York via Doha.

Qatar Airways A-350 Qsuites

- Redeem 57,000 Flying Club Miles to fly Virgin Atlantic Upper Class from Hong Kong to London.

Virgin Atlantic B-787 Upper Class

- Redeem 62,000 KrisFlyer miles to fly Singapore Airlines Business Class from anywhere in Australia to Bangkok via Singapore.

Singapore Airlines B-777 Business Class

- Redeem 41,600 Qantas points to fly Qantas Business Class from anywhere in Eastern Australia to Perth.

Qantas A-330 Business Class

In Conclusion

So there you have it. If you want to experience some of the world’s best business & first class flights, American Express Membership Rewards points can make it possible.

The above are just a few examples of what can be achieved, once you have mastered reading the redemption charts and become familiar with the various sweet-spots that they invariably present, you could easily extract tens of thousands of dollars worth of value from your points.

What is the best flight you have redeemed on points? Leave a comment below.

Thanks for the information