The unveiling of Star Alliance Credit Card is easily the most significant event in the credit card market in Australia in recent times. For the first time, Australian’s have an easy way to earn points and miles in programs that were difficult to break into until now. That said, the card is far from perfect.

In my opinion, Star Alliance have missed a great opportunity to shake-up the market by introducing a truly outstanding product. In this post I want to talk about some of those missed opportunities and what Star Alliance could do to improve them.

No Welcome Bonus

What do points and miles enthusiasts look for when they are considering opening a new card? Yup, a chunky welcome bonus in the form of bonus points. I would have loved to been a fly on the wall when the mandarins at Star Alliance were deliberating over the card.

Australian credit card market is extremely competitive and consumers have several dozens of cards to choose from, most of which offer some kind of welcome bonus. In this background, it is quite perplexing that a new player would enter the market with a $450 annual fee card (waived in the 1st year) and offer no bonus points. A welcome bonus of 75,000 points (in my humble opinion) would greatly improve the attraction of this card.

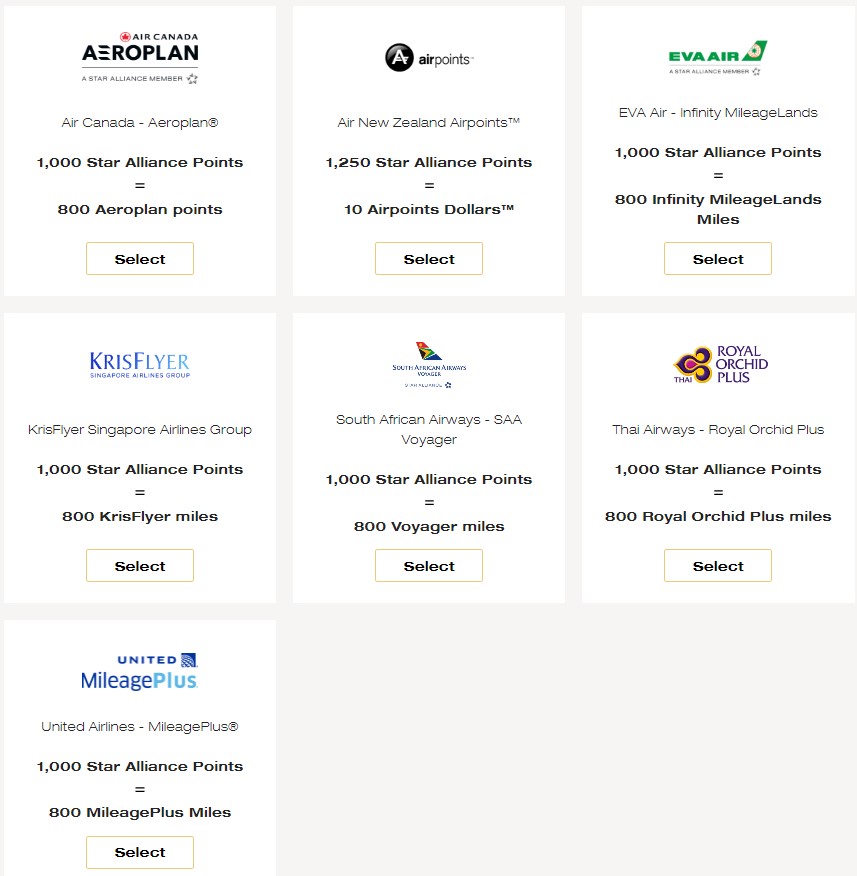

Small List of Transfer Partners

Star Alliance is made up of 26 member airlines, but only 7 of them are participating in the Star Alliance Rewards Program.

Star Alliance Rewards Transfer Partners

I am happy that the likes of Aeroplan, KrisFlyer and South African Airways – Voyager have chosen to be a part of it, but to have more than 70% of the members say they don’t wanna have anything to do with it doesn’t exactly help a fledgling program hoping to make an impression.

Now I realise that this is just the beginning and there is always a chance that more members may hop aboard later. Let’s hope that at the very least, Star Alliance can convince programs such as ANA Mileage Club, Avianca LifeMiles and Turkish Airlines Miles&Smiles to throw in their lot with the 7 existing partners.

Earnings Cap

The Star Alliance Card earns 1 Star Alliance Point per $1 on eligible spends of up to $3,000 per month, at which point the earning is cut by 50% to just 0.5 Star Alliance Point per $1.

Earn 1 point per $1 with Star Alliance Card on up to $3,000 per month

When you consider that the conversion rate from Star Alliance Points to Airlines Points is just 1:0.80 (1 Star Alliance Point = 0.80 Airline Points), the opportunity cost of putting the spend on this card as opposed to some of other products in the market is just huge. Let me explain this by giving you a very quick example.

Most Amex Cards in Australia earn the equivalent of at least 1 airline point per $1. Someone spending $5,000 per month on the Star Alliance Card will earn the equivalent of 3,400 Airline Points, put the same spend on Amex Explorer and you are looking at the equivalent of 5,000 Airlines Points in earnings. That’s a variance of 1,600 points per month or more than 19,000 points per year.

To have a cap of any kind, disincentivises spending. I sincerely hope that Star Alliance can see the value in dismantling the cap so that cardmembers can earn 1 Star Alliance Point per $1 uncapped. If that’s asking for too much, they should at least consider raising the threshold to $10,000 per month.

Offer Transfer Bonus

As points and miles collectors, the only perk we love more than Welcome Bonus is a good Transfer Bonus. Take a look at the current players in the market with transferrable currencies, American Express offers regular transfer bonuses, flybuys do it, Commbank Awards do it, as do most of the other major banks.

While it’s early days and we don’t know what will happen in future, I sincerely hope that Star Alliance Rewards can offer regular transfer bonuses. A 25% transfer bonus (for instance) improves the conversion ratio to 1:1 (1 Star Alliance Point = 1 Airline Point) and will be a tremendous incentive for cardholders to put more of their spend on the card.

Remove Foreign Transaction Fee

I will touch over this point only briefly. Star Alliance Card applies a 3% foreign transaction fee on spends made overseas and on online transactions with overseas merchants. This should go, and here’s why.

Star Alliance is a global alliance, its members are not restricted to any 1 geography. Why not have the same philosophy for the card? Between no welcome bonus, capped earnings and a severely curtailed roster of transfer partners, there is enough left on the table for Star Alliance to absorb this tiny cost.

In Conclusion

There you have it, my wish list of perks and additional features I would like to see on the Star Alliance Card. To be honest, there is little chance of any of them being adopted, unless the take-up of the card is so poor that it forces Star Alliance to re-evaluate things.

We live in hope 😉

Are you considering getting the Star Alliance Card? Leave a comment below.