The American Express Explorer Credit Card is offering increased Welcome Bonus of 80,000 Membership Rewards Points when you apply for the card via a personal referral link. The public offer is for 70,000 points, meaning using a referral link obtained from a family or friend will fetch you an extra 10,000 points.

The catch is that not everyone with an American Express Card is able to generate the 80k referral link. Most cards show the standard 70k offer, except for Amex Platinum cardholders who seem to have access to the 80k link.

To earn 80,000 Membership Rewards Points in Welcome Bonus;

- You must Apply for the Card via a personal referral link and be approved.

- Spend $4,000 on the card within 3 months of your card membership.

If you are unable to source the link from someone you know, feel free to use the links in this post which are good for the increased 80k Welcome Bonus.

The welcome bonus of 80,000 points can be transferred to one of Amex’ 9 airline partners such as Virgin Atlantic, Virgin Australia or Cathay Pacific Asia Miles at 2:1 (2 Amex Points = 1 Airline Point). As the card earns 2 Membership Rewards Points per $1 on most purchase, by the time you meet the minimum spend you would have earned a further 8,000 points (total 88,000 points) giving you 44,000 airline points in a Frequent Flyer Program of your choice.

That may not sound like a lot, but used strategically, those are enough points for a return overseas Business Class flight. More on this a little later.

The card carries a $395 annual fee, which is reasonable and is more than offset by the included perks.

Disclosure : If you apply for the card using links in this post and are approved, pointsHq or it’s related entity may receive some referral points.

Spending 88,000 Membership Rewards Points

Membership Rewards Points are a highly flexible points currency. Although you can book travel directly through Amex Travel & pay with Membership Rewards points, this isn’t the best use of points. You will extract a much higher value when you transfer the points to Frequent Flyer Programs such as Asia Miles, Velocity or Virgin Atlantic Flying Club & redeem them for Business Class flights.

For instance, you can transfer just 60,000 Membership Rewards Points to Virgin Atlantic Flying Club Program which in the ratio of 2:1 will give you 30,000 Virgin points. That’s enough points for a return business class flight between Australia & New Zealand flying Air New Zealand, and you will still have a balance of 28,000 points in your account.

Redeem Membership Rewards to fly Air New Zealand Business Class

Another excellent use of these points would be transferring 55,200 points to Etihad Guest Program and redeeming them for a return Virgin Australia Business Class flight between Sydney and Queenstown.

Redeem Membership Rewards Points to fly Virgin Australia Business Class

These are just a couple of examples of what can be achieved with just 1 welcome bonus, the versatile nature of Membership Rewards Points means the possibilities are only really limited by your own personal travel plans. If you want to learn more about Membership Rewards Program, I highly recommend you check out one of my earlier posts over here.

$400 Travel Credit

The American Express Explorer Credit Card comes with $400 in travel credit. You will receive this credit each year for as long as you have the card. You can use this credit to book travel through Amex Travel and pay for things such as flights, hotels and rental cars. As long as you travel at least once a year, the travel credit fully covers the cost of $395 annual fee, making the card effectively free.

Amex have a great video on their website explaining everything about the travel credit and how to use it, you can check that out over here.

Other Card Benefits

In addition to the $400 travel credit which is possibly the cards most valuable perk, cardmembers also enjoy a slew of other benefits. Some of these are:

Access to The Centurion Lounge in Australia

American Express operates 2 Centurion lounges in Australia, one at Sydney International Airport (Terminal 1) and the other at Tullamarine Airport in Melbourne.

I had reviewed the Sydney Lounge in 2019 soon after it reopened with increased capacity in an all new part of the Terminal. You can read that over here.

The Centurion Lounge at Sydney International Airport

The Explorer Card provides 2 single entry passes to the Centurion Lounges in Sydney & Melbourne. Solo travellers can use it on 2 separate occasions while couples travelling together are able to redeem both entries at once.

Amex sell these lounge passes for $65 a piece, that is a solid $130 in value to cardmembers each year.

Free Travel Insurance

Travel insurance is a vital part of any travel itinerary. They say if you can’t afford travel insurance, you can’t afford travel.

Luckily, American Express Explorer cardmembers never have to worry about paying for Travel insurance. You and your travelling party will be fully insured as long as you charge the full return airfare to the card, use travel credit or pay for your flights with Membership Rewards Points.

As Amex lets you add 4 additional cards at no extra cost, you can add other family members such as your parents to the card, who are then able to take advantage of some of the card perks such as Smartphone screen protection cover.

More on card’s insurance benefits here.

The Hotel Collection $100 Credit

The Hotel Collection is a benefit under which cardmembers who book a hotel for at-least 2 consecutive nights and pay with their Explorer card receive US $100 in credit.

The credit can be applied towards dining, spa and various hotel/resort activities, but not the cost of the room or taxes. If you book multiple rooms, the credit can be applied towards up to 3 rooms.

You can book JW Marriott Khao Lak under The Hotel Collection program

Note that the bookings must be made through American Express Travel Online and as such only covers hotels included in the program. This benefit was added to the Explorer card in 2019, as previously, it was restricted to the much more expensive American Express Platinum card only.

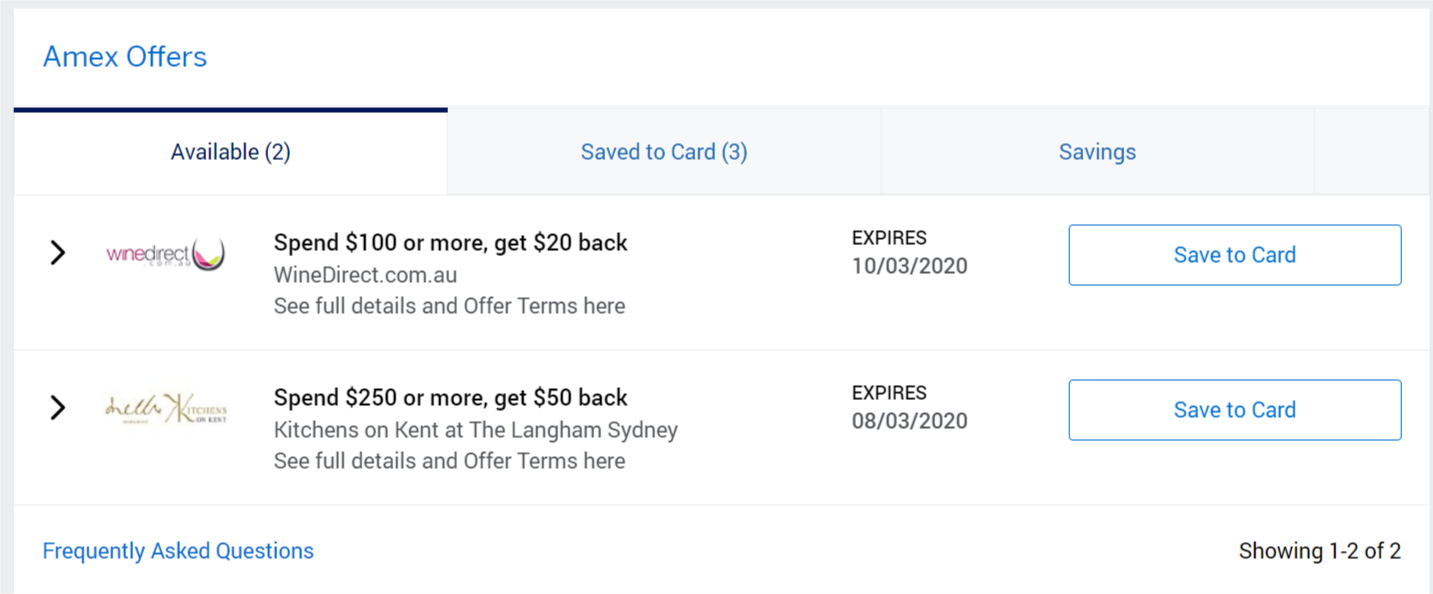

Amex Offers

Like all Amex cards, The American Express Explorer Credit Card is also eligible for Amex Offers. This is a great feature of American Express cards where different cards are eligible for different offers. Note that not every card is targeted for every offer. Also, some offers may only be available on primary cards where as others may be more widely available.

Personally speaking, I love Amex Offers. In many instances, the savings you make on the purchase is more than adequate to cover the annual fee on your card.

You can save hundreds of dollars every year by taking advantage of Amex Offers

Who can apply for this card?

American Express Cards are one of the easiest cards to obtain in Australia, unless you have a particularly bad credit history, I can’t imagine getting approval will be an issue. That said, make sure you meet the following conditions before you shoot-off the application.

You are eligible to apply for this card if :

- You are at-least 18 years old.

- You are an Australian citizen, permanent resident or on a long term visa of 1 year or longer, excluding student visa.

- You agree to receive your statements online through American Express.

- You have a good credit history and no payment defaults.

In Conclusion

If you are interested in getting the American Express Explorer Credit Card, now is a good time to apply via a personal referral link as this will earn you a Welcome Bonus of 80,000 Membership Rewards Points after spending $4,000 on the card within 3 months. This is an extra 10,000 points over the standard offer.

As with all American Express cards, Amex applies a strict criteria in determining the eligibility for welcome bonus. Basically, anyone who has held an American Express card at any time in the past 18 months is excluded, although this does not include the two co-branded David Jones cards.

Apply here for 80,000 Points Welcome Bonus on The American Express Explorer Credit Card